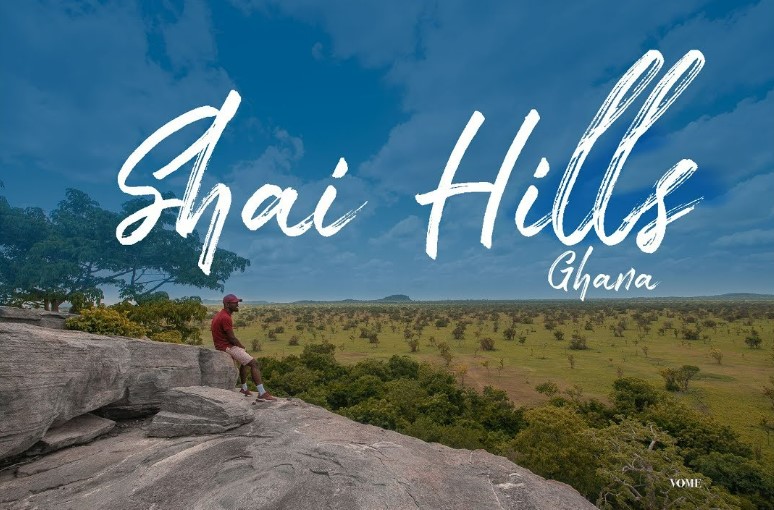

Land Inflation in Ghana: A Case Study of Shai Hills and Foreign Land Acquisition

The Growing Impact of Land Inflation in Ghana: A Heartfelt Look at Shai Hills and Foreign Acquisitions. Land is more than dirt and grass—it connects to our roots, history, and future. In Ghana, however, the rising issue of land inflation leaves many local farmers and families feeling disconnected from the land they’ve called home for generations. The cause? A surge in foreign investment, with Chinese companies leading the charge in areas like Shai Hills, a region known for its fertile soil and proximity to Accra. But the problem isn’t just about the price hikes; it’s about community displacement, unfulfilled promises, and the growing gap between local livelihoods and foreign profits. Shai Hills, once a haven for local farmers, faces an unsettling transformation. Just outside Accra, this once-thriving agricultural community is being overtaken by foreign investors, particularly from China, who have acquired large portions of land with promises of development. Yet, those promises remain unfulfilled. Foreign Influence and the Promise of Development Companies like Hainan Zhongtai International Investment, China Export-Import Bank, and Sakata Seed Corporation were drawn to Shai Hills for its rich agricultural potential. However, according to the Ghana Land Commission, 40% of foreign land acquisitions over the last decade remain undeveloped. Instead of cultivating the land, these companies hold onto it for profit, waiting for its value to rise before reselling, while the local community suffers. Sakata Seed Corporation, for example, announced ambitious agricultural expansion, but as of 2023, the land remains abandoned and unused. Meanwhile, land prices soar, making it impossible for local farmers to afford what was once theirs. The heartbreaking reality is that these foreign investments are doing more harm than good, leaving Shai Hills residents displaced, struggling, and questioning whether these “developments” were ever meant to help them. The Land Banking Crisis: Holding Land for Profits, Not People It’s a practice that’s becoming all too familiar in Ghana’s land market: land banking. This is when foreign companies—rather than developing land for agriculture or industry as promised—simply hold onto it in hopes of watching the land value increase. For local communities, this is devastating. The price of land in Shai Hills has skyrocketed over the past five years, with values increasing by as much as 25% annually. For example, land that once sold for GHS 10,000 per plot is now priced at least GHS 40,000 or more. But where’s the progress? Where are the jobs, the farms, the industries that were supposed to grow? Instead, local farmers are left behind, unable to afford land that once belonged to them, while foreign investors profit by simply holding onto it. Voices from the Ground: The Local Struggle The frustration among Shai Hills residents is palpable. One local activist explained, “Foreign companies come, take the land, and promise us prosperity. But instead, we’re being pushed out, and they’re making huge profits while we lose our homes and farms.” A farmer in Shai Hills said, “We were told these companies would help us, bring jobs and development. But now, the land is just sitting there, and we can’t even afford to buy land to farm anymore.” What is deeply concerning is the growing sense of helplessness. Land inflation is not just a statistic—it’s a daily struggle for families being pushed out of their communities. And while foreign investors get richer, locals are forced to watch the land they’ve relied on for generations slip through their fingers. What Needs to Change? The situation in Shai Hills is a wake-up call. Ghana is a nation rich in resources and potential, but the current trend of unchecked foreign land acquisitions threatens to undermine the very foundation of local communities. Ghana’s government must regulate foreign investments more carefully, ensuring that land acquisitions lead to real, tangible benefits for the people rather than empty promises and inflated land values. It’s clear that foreign investments should be paired with strict guidelines that ensure land development aligns with local communities’ needs. The government must hold investors accountable by requiring clear timelines and development plans. Those who fail to fulfill their commitments should face penalties, and foreign investors should be encouraged to work in partnership with local people, fostering mutual growth rather than profit at the expense of locals. A Call for Social Responsiveness At the end of the day, land isn’t just a commodity—it’s a home, a livelihood, and a heritage. It’s essential that we treat the land—and the people who work it—with the respect they deserve. Foreign investors, including Chinese companies, have an important role in Ghana’s development, but that role should never come at the expense of the people they aim to help. One local farmer said, “We don’t mind foreign investors coming to help develop our land. But we do mind when they take our land and leave us with nothing but promises.” This is more than an economic issue—it’s a human issue. It’s about ensuring that Ghana’s prosperity is shared by everyone, not just foreign investors looking to profit. Let’s hold the conversation accountable and demand transparency and fair treatment that will allow Ghana to flourish in a way that benefits all. A Game-Changing Opportunity @Shai Hills! The Accra-Tema-Mpakadan railway project is a game-changer for the region, with a new train station in Shai Hills set to revolutionize transport and trade, bringing much-needed economic growth. Companies like Dangote Cement Ghana, which provides over 2,000 jobs in construction and logistics; Voltic Ghana, a Coca-Cola subsidiary that supports local suppliers and employs hundreds; Blue Skies Ghana, which partners with local farmers to export fresh produce globally; Twifo Oil Palm Plantation Ltd., which runs a fully operational palm plantation and creates sustainable jobs, and United Steel Company Ltd., a leading industrial player expanding its operations and hiring locally, are all making a real difference in the lives of the people in Shai Hills, offering hope, jobs, and a brighter future. Sources: Ghana Land Commission 2023 Report on Land Acquisitions Ghana Investment Promotion Centre (GIPC) 2022 Annual Report The Economic Impact of Foreign Land Acquisitions in

The Remote Work Revolution: What It Means for Real Estate in Ghana and Africa

By the end of this decade, the world could see a 25% increase in remote digital jobs, according to the World Economic Forum report, Realizing the Potential of Global Digital Jobs. But the big question is, where will these workers be based? Remote work is reshaping how people live and work, creating opportunities for countries like Ghana and others across Africa to attract digital nomads, freelancers, and remote employees. With the right infrastructure, Africa could position itself as a top destination for remote workers, leading to significant implications for industries like real estate. How Remote Work Impacts Real Estate in Ghana and Africa A Growing Opportunity for Ghana Ghana’s vibrant culture, affordable cost of living, and improving tech infrastructure make it a potential hotspot for remote workers. Cities like Accra and Kumasi can capitalize on this trend by: Interesting Stats What Does This Mean for Real Estate Investors? Real estate developers in Ghana and across Africa should start adapting their projects to cater to the new needs of remote workers. Building smarter homes, co-living spaces, and hybrid workspaces will be key to attracting this growing market. Remote work isn’t just a trend—it’s a transformation opening up exciting opportunities for Ghana and Africa. The future of work could very well redefine the real estate industry. Are you ready to make the most of it?

Bridging the Gap: Addressing Property Valuation Disparities in Ghana

Property valuation disparities in Ghana have been a longstanding issue, with significant implications for individuals, communities, and the economy at large. The valuation of properties plays a crucial role in various aspects of society, including taxation, investment, and access to credit. However, disparities in property valuation can lead to inequities and hinder economic development. One of the key factors contributing to property valuation disparities in Ghana is the lack of standardized valuation methods and data. In many cases, property valuations are based on subjective assessments rather than objective criteria, leading to inconsistencies and inaccuracies. This can result in some properties being undervalued while others are overvalued, creating an uneven playing field for property owners. Furthermore, there are often disparities in the valuation of properties in urban and rural areas. Urban properties tend to be valued higher than rural properties, reflecting the differences in economic activity and infrastructure. However, this can perpetuate inequalities and hinder the development of rural areas. To address these disparities, it is essential to implement standardized valuation methods and improve the quality and availability of property data. This could involve the use of technology, such as geographic information systems (GIS) and remote sensing, to gather accurate and up-to-date information about properties. Additionally, training and capacity building for property valuers can help ensure that valuations are conducted using consistent and transparent methods. Another important step is to promote public awareness and engagement on property valuation issues. By involving stakeholders, including property owners, local communities, and government agencies, in the valuation process, it is possible to increase transparency and accountability. This can help build trust in the valuation system and ensure that valuations reflect the true value of properties. Furthermore, addressing property valuation disparities requires a multi-sectoral approach, involving collaboration between government agencies, the private sector, and civil society organizations. By working together, it is possible to develop comprehensive solutions that take into account the diverse factors influencing property valuations in Ghana. In conclusion, addressing property valuation disparities in Ghana is crucial for promoting equity, economic development, and sustainable urban and rural growth. By implementing standardized valuation methods, improving data quality, and promoting public engagement, it is possible to bridge the gap and create a fair and transparent property valuation system that benefits all stakeholders.

How Airbnb is Shaking Up West African Real Estate (and Why It’s a Game-Changer)

Airbnb is rapidly transforming the real estate market in West Africa, and it’s not just a passing trend. Cities like Accra, Lagos, and Dakar are seeing huge shifts thanks to the growing demand for short-term rentals. Property owners and investors are getting creative, turning traditional rentals into Airbnb-ready spaces to cash in on this booming market. Airbnb’s Influence on the Market: Positive Potentials for the Future: Looking Ahead: It’s clear that Airbnb is not just changing how people travel in West Africa—it’s reshaping the real estate landscape. Whether you’re a homeowner, investor, or just someone looking to make extra income, there’s a lot of potential. As the market grows, Airbnb is set to play an even bigger role in the future of real estate across West Africa. So, if you’re eyeing West Africa’s real estate market, now might be the perfect time to jump in. The opportunities are big, and Airbnb is paving the way for new growth and profitability in the region.

The Optimal Destination for Acquiring Properties, Smart Building Materials, and Tools: A Smart Investment in Real Estate

The global real estate market is evolving rapidly, and savvy investors are increasingly focusing on smart and innovative building solutions. Whether you are looking to acquire new properties or enhance existing ones, choosing the right destination for purchasing cutting-edge materials and tools is key to maximizing both value and sustainability. The Importance of Smart Real Estate Investment Investing in smart and innovative real estate is no longer a trend but a necessity. The demand for energy-efficient, sustainable, and tech-integrated homes is growing exponentially. As urbanization increases and climate concerns become more pressing, properties with smart building features are likely to yield higher returns. For both residential and commercial properties, integrating smart technologies such as automated lighting, security systems, and energy management solutions can significantly reduce operational costs while enhancing comfort and security. Key Building Materials and Tools To construct or upgrade smart buildings, innovative materials and tools play a crucial role. Here are some essential materials and technologies driving the smart building revolution: Top Destinations for Acquiring Smart Building Materials When considering the best markets to acquire smart building materials and tools, the following regions stand out: Conclusion Investing in smart real estate and acquiring the right building materials is a strategic move for any forward-thinking investor. By focusing on energy efficiency, sustainability, and the integration of smart technologies, properties can not only meet the demands of modern buyers but also provide significant long-term value. At Loveridge Properties and Consult, we specialize in helping investors navigate the ever-changing landscape of smart real estate, guiding you toward the best markets and materials for your projects. Contact us today to learn more about how smart investments can transform your real estate portfolio.

Post-Pandemic Shifts in Real Estate Preferences: 2024 Trends

The COVID-19 pandemic has left an indelible mark on many industries, with real estate being one of the most affected. As we move through 2024, buyer preferences in the housing market have notably shifted, reflecting new priorities that emerged during the pandemic. The focus has moved from urban hubs to more spacious, adaptable, and nature-friendly living environments. 1. Suburban and Rural Living on the Rise Before the pandemic, urban living was seen as highly desirable for many homebuyers due to proximity to work, entertainment, and social opportunities. However, since 2020, we’ve witnessed a significant trend toward suburban and rural areas. This shift continues in 2024 as remote and hybrid work models remain popular. According to recent data, suburban property sales have surged by nearly 25% in regions surrounding major cities like New York and Los Angeles, while rural areas have seen a 15% uptick in demand. This trend is driven by the desire for larger homes, more privacy, and outdoor spaces, with buyers prioritizing locations that offer more flexibility and comfort for remote working lifestyles. 2. Home Offices as a Necessity With millions of people working from home for the near future, dedicated home office spaces have become a primary concern for homebuyers. In fact, a study by Zillow revealed that 73% of prospective buyers now consider a home office a key feature in their home search. Many are looking for houses with two or more office spaces, especially those in dual-income households where both partners work remotely. Builders and sellers are responding to this demand by incorporating dedicated office spaces or adaptable rooms into their designs. Properties with built-in offices, high-speed internet infrastructure, and private workspaces are commanding higher prices compared to those without. 3. Outdoor Spaces and Nature Integration The desire for outdoor living spaces continues to grow in 2024. Buyers are no longer just looking for large homes but also for properties that offer easy access to outdoor activities. Decks, patios, and gardens are now seen as essential features, while proximity to parks, nature reserves, and trails has become a strong selling point. A survey by the National Association of Realtors found that over 60% of homebuyers in 2023 sought homes with large outdoor spaces, reflecting the shift away from city apartments. As a result, suburban developments with access to nature and outdoor amenities are seeing increased demand. 4. Multi-functional Living Spaces Flexibility is key in 2024 as homes must serve multiple functions—living spaces, workspaces, and entertainment hubs. Buyers are increasingly drawn to homes that offer open floor plans or multi-functional rooms that can easily adapt to changing needs, whether for work, family gatherings, or fitness activities. Properties with convertible spaces, such as finished basements, attics, or additional guest rooms that can serve as home offices, are in high demand. 5. Sustainable and Energy-Efficient Homes Sustainability has also become a significant factor in buyer preferences. Homes with energy-efficient appliances, solar panels, and eco-friendly materials are seeing more interest. As climate awareness grows, buyers are looking for properties that align with their values while also reducing long-term costs through energy efficiency. Data from Redfin shows that 43% of homebuyers consider energy-efficient features an important factor in their purchasing decision, and many are willing to pay a premium for homes that incorporate green building techniques. 6. Urban Real Estate: A Shift in Purpose While suburban and rural areas are flourishing, urban real estate markets are not entirely in decline. Cities are evolving to meet the changing demands of residents. There’s a noticeable shift toward mixed-use developments that combine residential, commercial, and recreational spaces. These developments aim to provide a more holistic living experience, blending the conveniences of city life with the spaciousness that suburban homes offer. Additionally, city buyers are prioritizing amenities such as gyms, coworking spaces, and easy access to public transportation, which could accommodate future hybrid work schedules. Conclusion The real estate market has dramatically shifted post-pandemic, with suburban and rural properties becoming highly sought after for their space, privacy, and flexibility. Homebuyers in 2024 are prioritizing home offices, outdoor spaces, and multi-functional homes that can adapt to the changing demands of modern life. Sustainable living and energy-efficient homes are also on the rise, reflecting a growing awareness of environmental concerns. At Loveridge Properties and Consult, we understand these evolving trends and are here to guide buyers and sellers through the ever-changing landscape. Whether you’re seeking a spacious suburban home or exploring eco-friendly options, we’re ready to help you find the perfect property to meet your needs.

Essential Considerations When Choosing Concrete

When it comes to constructing or renovating a property, choosing the right building materials is crucial for ensuring longevity, strength, and overall quality. Concrete, a fundamental material in construction, offers various benefits but also comes with certain considerations. At Loveridge Properties and Consult, we aim to provide you with essential information to help you make informed decisions. Here’s what you need to know before choosing concrete for your project. Understanding Concrete Composition Concrete is a composite material composed of cement, water, aggregates (sand, gravel, or crushed stone), and admixtures. The proportions of these components can significantly influence the properties of the concrete. For instance: Benefits of Using Concrete 1. Durability Concrete is known for its high durability and resistance to environmental factors such as weather, chemical exposure, and wear and tear. This makes it ideal for both residential and commercial constructions. 2. Strength The compressive strength of concrete allows it to withstand heavy loads, making it suitable for structural components like foundations, columns, and beams. 3. Versatility Concrete can be molded into various shapes and sizes, allowing for creative architectural designs and applications in different types of construction projects. 4. Energy Efficiency Concrete has thermal mass properties that help in regulating indoor temperatures, leading to energy savings in heating and cooling. 5. Fire Resistance Concrete is non-combustible, which adds an extra layer of safety to buildings by slowing down the spread of fire. Considerations Before Choosing Concrete 1. Quality of Materials Ensure that high-quality raw materials are used in the concrete mix. Poor-quality aggregates or incorrect water-to-cement ratios can compromise the strength and durability of the concrete. 2. Environmental Impact Concrete production involves significant carbon emissions due to the manufacturing of cement. Opt for eco-friendly alternatives like recycled aggregates or supplementary cementitious materials (SCMs) to reduce the environmental footprint. 3. Curing Process Proper curing is essential to achieve the desired strength and durability. Curing involves maintaining adequate moisture, temperature, and time for the concrete to set and gain strength. 4. Cost While concrete is generally cost-effective, the price can vary based on the type of cement, additives, and labor costs. It’s essential to balance quality and budget considerations. 5. Maintenance Although concrete is low maintenance, it is not maintenance-free. Regular inspections and minor repairs can prevent more significant issues like cracks and surface degradation. Innovative Concrete Solutions At Loveridge Properties and Consult, we stay updated with the latest advancements in concrete technology. Some innovative solutions include: Conclusion Choosing the right concrete mix and understanding its properties can significantly impact the success of your construction project. At Loveridge Properties and Consult, we are committed to providing expert advice and high-quality materials to ensure your project stands the test of time. For more information and professional guidance, visit our website at Loveridge Properties and Consult.

Why Source Building Materials in China?

At Loveridge Properties and Consult, we specialize in sourcing and shipping building materials worldwide, providing our clients with high-quality products at competitive prices. One of our key sourcing destinations is China, and here’s why sourcing building materials from China can be highly advantageous for your construction projects. 1. Cost-Effectiveness China is known for its cost-efficient production processes. Manufacturers in China benefit from economies of scale, advanced technology, and a large labor force, enabling them to produce high-quality materials at lower costs compared to many other countries. This cost advantage is often passed down to buyers, allowing you to get more value for your money. 2. Diverse Range of Products China’s vast manufacturing sector produces a wide variety of building materials, from basic supplies like cement and steel to more specialized items like high-performance glass and advanced insulation materials. Whether you’re looking for bulk materials or specific products tailored to unique project requirements, you can find a diverse range of options to meet your needs. 3. Advanced Technology and Innovation Chinese manufacturers are at the forefront of technological innovation in the construction industry. Many companies invest heavily in research and development, ensuring that their products incorporate the latest advancements in building technology. This includes sustainable materials, energy-efficient products, and cutting-edge construction techniques that can enhance the quality and performance of your projects. 4. Quality Assurance Contrary to some misconceptions, many Chinese manufacturers adhere to stringent quality control standards. By partnering with reputable suppliers and conducting thorough due diligence, you can ensure that the materials you source from China meet international quality standards. At Loveridge Properties and Consult, we assist in vetting suppliers and verifying product quality to give you peace of mind. 5. Scalability and Large-Scale Supply China’s manufacturing capacity is unmatched, making it an ideal source for large-scale projects that require substantial quantities of building materials. Whether you’re constructing residential complexes, commercial buildings, or infrastructure projects, Chinese suppliers can scale up production to meet your demands, ensuring timely delivery and consistent supply. 6. Customization and Flexibility Chinese manufacturers are often willing to customize products to meet specific project requirements. Whether you need materials in non-standard sizes, bespoke designs, or specific performance characteristics, many suppliers are flexible and can tailor their offerings to suit your needs. This customization capability is crucial for projects that require unique solutions. 7. Efficient Logistics and Shipping China’s well-developed logistics and shipping infrastructure make it easier to transport goods worldwide. With major ports and efficient supply chain networks, you can expect reliable and timely delivery of materials. At Loveridge Properties and Consult, we handle the logistics to ensure that your materials arrive safely and on time, no matter where your project is located. Conclusion Sourcing building materials from China offers numerous advantages, from cost savings and diverse product options to advanced technology and reliable supply chains. At Loveridge Properties and Consult, we leverage our expertise and network to help you navigate the sourcing process, ensuring you receive high-quality materials that meet your project’s requirements. If you’re considering sourcing building materials from China or need assistance with your procurement needs, contact us today. Let us help you bring your construction projects to life with the best materials available on the global market.

The Future of Investment in Prampram, Ghana and Its Environs

Prampram, a coastal town in Ghana, is rapidly becoming a hotspot for significant investment opportunities thanks to strategic infrastructure developments and urbanization projects. Here’s a glimpse into some of the planned future investments that promise to transform Prampram and its surroundings into a hub of economic and social activity. 1. Ningo-Prampram Planned City Extension Project One of the most ambitious projects in the region is the Ningo-Prampram Planned City Extension Project, valued at approximately USD 4.8 billion. This project addresses the acute shortage of decent, affordable housing for lower and middle-income groups by providing up to 500,000 affordable homes and serviced plots. The project also includes the development of vital infrastructure such as roads, drainage systems, power, water, and telecommunications. This initiative is expected to prevent haphazard development and slum formation, efficiently using land while protecting environmentally sensitive areas. The project is being spearheaded by a consortium of private developers, including LAHOSE GH LTD and its partners, and is supported by local and central government agencies. The phased implementation of this project will also create numerous job opportunities, further boosting the local economy (Modern Ghana) (Ghana News Agency). 2. Modernizing Agriculture in Ghana (MAG) Project The MAG project, funded by the Canadian Department for Foreign Affairs Trade and Development, aims to modernize agriculture in the Ningo-Prampram District. This project has significantly improved agricultural practices through training sessions, stakeholder engagement, and the introduction of market-oriented approaches. By enhancing productivity and value chain development, the MAG project has created new job opportunities and improved the livelihoods of local farmers. The focus on sustainable agriculture and value addition ensures that the benefits of this project will be long-lasting (Ghana News Agency). 3. Springfield Estate Development Springfield Estate, developed by Swami India Ghana Ltd., is set to redefine luxury living in Prampram. This real estate development offers premium serviced plots with modern amenities, catering to residential and commercial needs. The strategic location and high-quality infrastructure make Springfield Estate an attractive investment for those looking to capitalize on the growing demand for upscale properties in the region (UN-Habitat). 4. Prampram Wind Farm Another significant regional investment is the Prampram Wind Farm, an 86MW onshore wind power project. This renewable energy project is expected to contribute to Ghana’s energy mix, providing a sustainable power source and supporting the country’s efforts to achieve energy security. The wind farm will also create job opportunities and stimulate economic activities (UN-Habitat). Conclusion Prampram and its environs are poised for substantial growth, driven by strategic investments in housing, agriculture, real estate, and renewable energy. These projects promise to enhance the region’s infrastructure and living standards and create many opportunities for investors and local communities. At Loveridge Properties and Consult, we are excited about the future of Prampram. We are committed to providing expert advice and services to help you navigate and capitalize on these investment opportunities. Whether you are looking to invest in real estate, agricultural projects, or renewable energy, we are here to guide you every step of the way. For more detailed insights and personalized advice, contact our Loveridge Properties and Consult team. We look forward to helping you make informed investment decisions in this rapidly developing region.

The Valuation of Ghanaian Real Estate: A Booming Market

Ghana’s real estate market is on an upward trajectory, reflecting significant growth and promising opportunities for investors and homeowners alike. According to recent projections, the market value of real estate in Ghana is anticipated to reach an impressive USD 458.50 billion in 2024. This substantial growth is driven by several key factors, including population growth, urbanization, and a rising demand for affordable housing solutions. Key Drivers of Market Growth Projections and Future Outlook The projected annual growth rate (CAGR) from 2024 to 2028 is 5.48%, indicating sustained momentum in the real estate market. By 2028, the market volume is expected to reach USD 567.60 billion. This optimistic outlook presents ample opportunities for investors, developers, and stakeholders to capitalize on the burgeoning market and contribute to its expansion. Challenges and Opportunities While the growth prospects are promising, the sector also faces several challenges: Conclusion Ghana’s real estate market stands at a pivotal juncture, poised for remarkable growth in the coming years. The increasing demand for affordable housing, coupled with urbanization trends, presents lucrative opportunities for investment and development. However, realizing this potential requires proactive measures to address existing challenges and create an enabling environment for sustainable growth. At Loveridge Properties and Consult, we are committed to providing insights and expertise to help you navigate Ghanaian real estate’s dynamic and ever-evolving landscape. Whether you are an investor looking for opportunities or a homeowner seeking your dream property, we are here to guide you every step of the way.